We have reached peak regular giving. So what next?

One of the things that has become apparent in Bluefrog’s ongoing qualitative research is a growing sense of negativity surrounding the issue of monthly gifts – particularly those paid by direct debits.

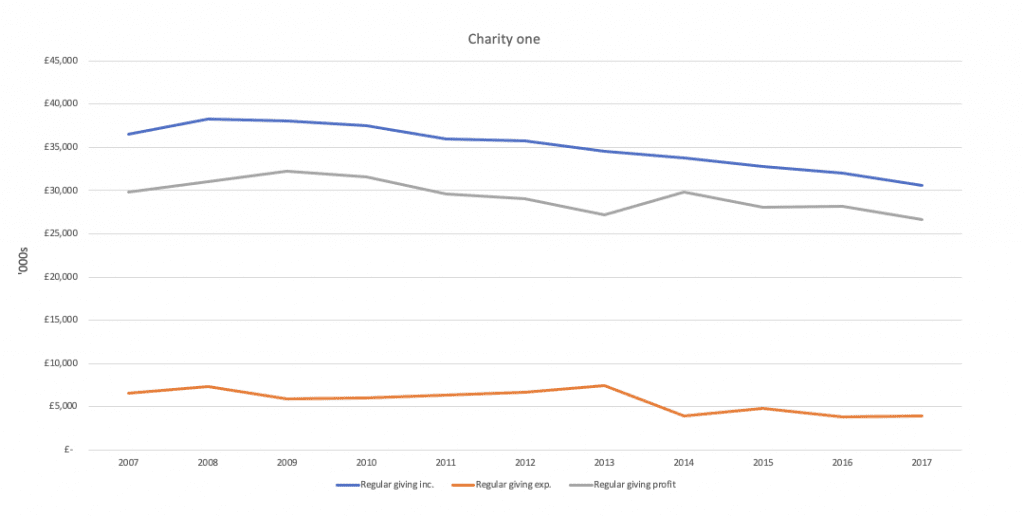

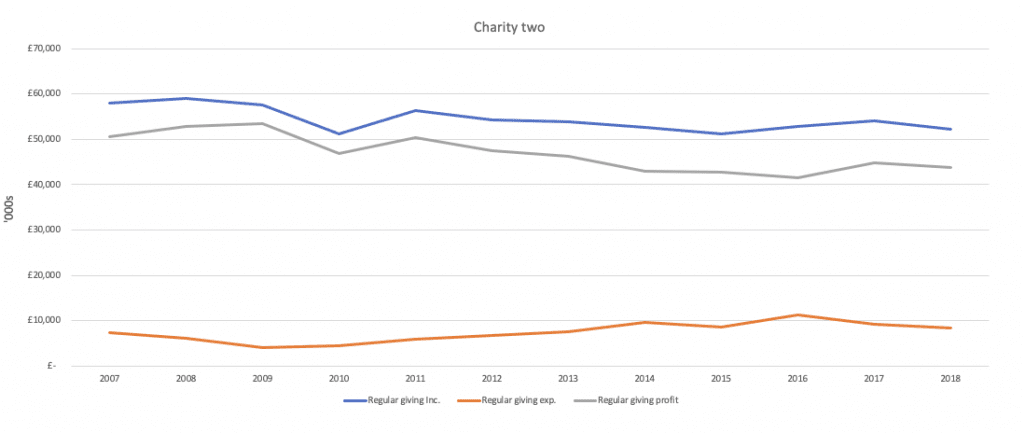

This appears to be more than a general gripe. Take a look at the annual reports of some of the (precious few) charities that publicly share regular giving (RG) income and expenditure figures and you'll see that they are spending huge sums whilst struggling to maintain the size of their files.

Both files are huge. Charity One is generating over £30 million a year from RG whereas Charity Two is bringing in over £52 million. But you can see a decline in the value of both. Let's look at those numbers in a slightly different way and we have a more alarming perspective. Since it generated a peak RG income of £38.3 million back in 2008, Charity One has invested over £56 million in their RG fundraising only to see yearly income from this source fall by £7.7 million.

Charity Two is in a similar position. Since 2008, they have spent over £82 million on RG acquisition and development only to see the yearly value of income from RG fall by £6.8 million.

Of course, they may have made a strategic decision to have fewer regular givers. Both have reduced RG expenditure in recent years, but this appears to be in the face of a changing environment rather than a reason for the decline. Other charities that report RG income in their annual reports (but not expenditure) also show a drop in regular giving.

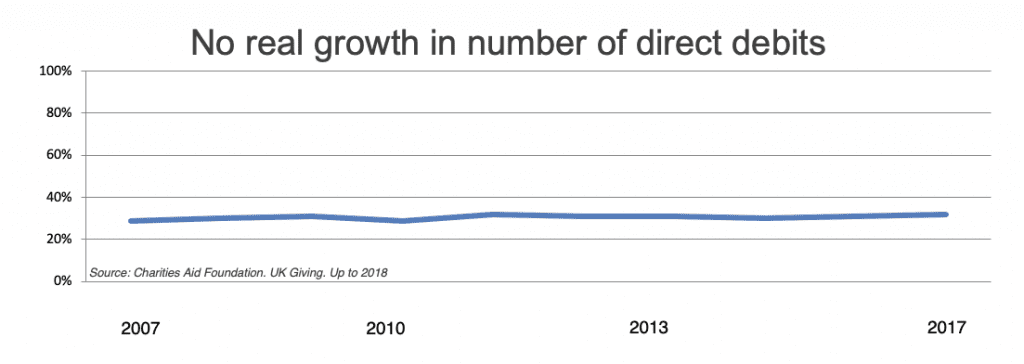

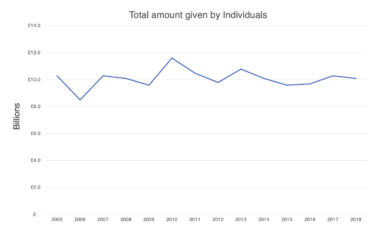

All of which leads me to the conclusion that we have reached peak regular giving. Each year CAF publish UK Giving, where they share data on how people give. Collate the data from the last decade and you'll see that giving by direct debit is stuck at between 30 and 32% of the giving population.

This is in the face of a report from the IOF showing that public fundraising signed up 864,500 new direct debits in the year 2017/18 (up from 598,00 to 2016/17). Add to that the RG donors recruited from TV, online, text, DM, radio and it makes you wonder where they have all gone?

Some regular gifts may be from new donors replacing those from people who have died. But look at the demographic data and you'll see that about 600,000 people die each year in the UK. Older people do have more charity direct debits than the younger generations but it's still not enough to explain the stagnation by a very wide margin.

It would appear far more likely that, on a sector-wide basis, regular giving recruitment is proportional to cancellations.

As Rapidata's most recent Charity Direct Debit Tracking Report (2017) showed, outside of times of crisis, average cancellation rates run at about 3% a month - or a third of all direct debits a year. It looks highly likely that the desire amongst fundraisers for direct debits is sustained by a group of donors who like to spread their giving around, switching charities according to who asks, or to fit their changing personal concerns.

Which brings us back to the my starting point – we have reached peak regular giving. I recently read a report from an Ofgem consumer panel survey on household utility payments which highlighted people's concerns about direct debits. Several panelists noted that direct debits can effectively allow organisations to...

"reach into your bank account and take as much as they want".

A couple of panelists explained that they had changed to standard credit payments to actively transfer money rather than allow companies to simply take it from their account.

We've seen similar concerns shared in Bluefrog studies. Some people report that they feel increasingly out of control of their bank accounts and are trying to reduce financial stress caused by 'accidentally' going overdrawn. They want less 'noise' in their finances. There is a growing sense that direct debits have been used to take advantage of them which makes them feel vulnerable or – even worse – stupid. This breeds resentment.

And when it comes to charities, donors are increasingly happy to say that a cash relationship is better than one based on automated payments. Some describe direct debits as actually removing the joy and sense of purpose they get from giving. Of course, you still have a significant group of people who value the ease offered by direct debits. But it's becoming more common for donors to really question why they need to sign up to another one?

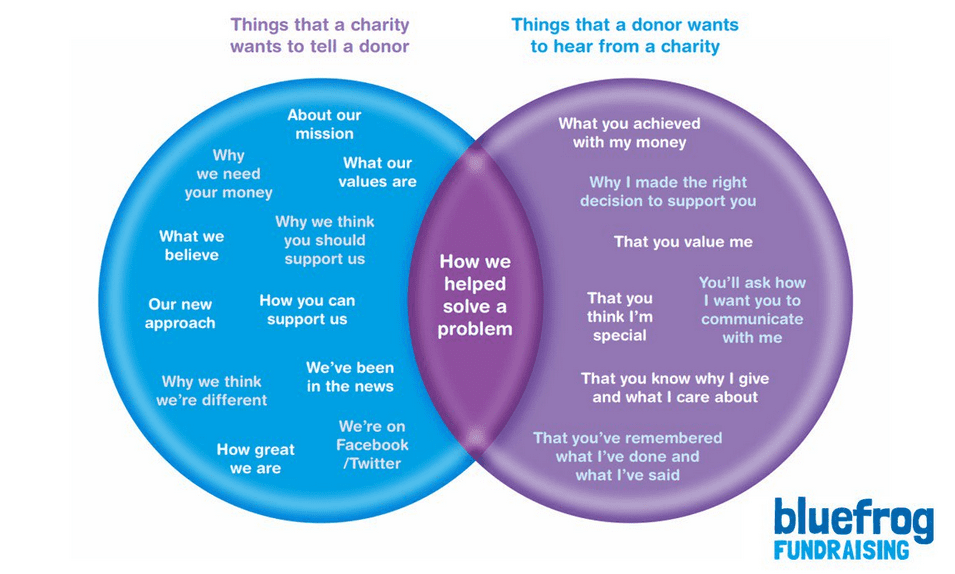

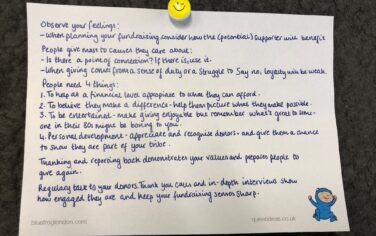

That means that we need a strong answer. The days of simply saying 'it's more efficient' or 'helps us plan' are over. As are the days of untargeted, general recruitment of regular givers. I've written about this before on SOFII for The Commission for the Donor Experience. If there is no connection to a cause or issue, the bonds of loyalty are as fragile as the logic behind a no-deal Brexit.

Just because someone will sign up to a direct request to give a direct debit, is no guarantee they will stay loyal. So if you want regular givers who are going to stick around and actually cover their recruitment cost, I've put together a five-step approach that's not a bad starting point to set you on the right route.

- Identify people who care about your cause. The number of fundraisers who want 'new donors' whilst ignoring those donors who hunt down their charity still amazes me. If you receive unsolicited gifts (often online) ask the donor why they decided to give to you and offer them a chance to choose how they support you moving forwards – with a regular gift. And don't give me any 'they won't respond' rubbish. Unsolicited donors have worked hard to find you. Engage them properly and you'll have the regular gifts you are looking for. Some of the most effective fundraisers that I work with are those that have given up industrial style recruitment.

- Use your data. Years ago fundraisers used a simple technique to work out which people might like to sign up to a regular gift. We looked for people who had given two decent-sized cash gifts within the last 18 months. They were the most receptive group - and they still are. You can also use other records in your data to identify your most committed supporters. Look for people who have contacted you to notify you of a change of address or who regularly give you more than you ask for in your appeals.

- Offer an extra reason to give. Think about what your donor needs. A regular gift should come with some reward. It could be authentic feedback showing donors what they have achieved. It could be the membership of a club. It could be the chance to network with like-minded people or an invite to an event. It might even be the chance to hit a personally relevant target or a focus on a specific area of work. All can answer additional needs other than to simply help.

- Focus on overcoming barriers. Donors often cite that they have too many direct debits. As they age, they want to shrink their charity portfolios. Respect that. Offer them control over their giving. Rather than just ask for an upgrade - consider a downgrade in the same package or phone call. If they value your work – and they can afford it – it won't detract from how much they give to you.

- Be thankful - and show it. When you demonstrate that you value a donor by showing simple respect, it will have an impact on how they view every aspect of your charity's work. Personal thanking that happens long before an ask for regular gift is made shows that you won't take a donor for granted. Your goal is to show them that your work depends on their kindness and generosity - and that you know it!

And remember – regular giving is not the final goal of any fundraising programme. Our focus as fundraisers is to provide donors with the tools they need to build a relationship that works for them. You are not creating a campaign aimed at generating £5 or $5 a month gifts. You are laying the foundations for a great legacy fundraising programme.

Tags In

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

A guide to fundraising on the back of a postcard

What does the latest research tell us about the state of fundraising?