I think Kiva needs some fundraisers

If you support Kiva, you'll probably know that kivafriends.org is a great resource.

(If for some reason you haven't yet heard of Kiva, can I recommend that you visit their site – hopefully lending a few quid whilst you're at it – or check out this brief explanation before reading any further).

It's packed full of great information and gives access to the Kiva community. They are a fantastic bunch, particularly those that spend their time analysing the massive amount of data that the site generates.

I've recently joined them and I've been spending a fair amount of my own time looking at some of the most important indicators of how the recession is impacting on the organisations growth. I've concentrated on the period from December the 1st, 2007 right through to the 31st of January, 2009.

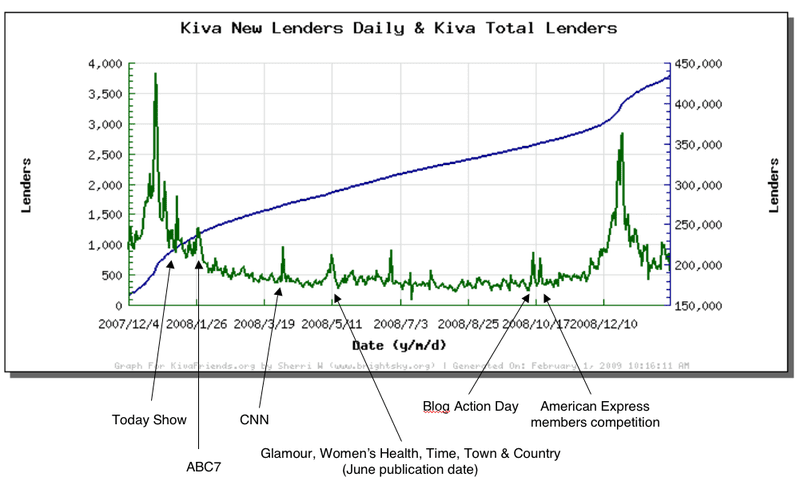

The first chart compares the number of new lenders (green) against the growth of the total Kiva lending population (blue). As you'll see, the green line isn't that dissimilar from what we might find in the more conventional fundraising world, with massive spurts of growth at Christmas.

I've highlighted what appears to have caused the mini-spikes throughout the year. Apart from the normal media driven peaks (primarily driven by TV), it's interesting to note (what looks like) the positive impact of blog action day and the American Express Members Project.

But it's those massive Christmas spikes that are most interesting. Kiva, it seems, is as popular as a source of Christmas gifts as the virtual gifts that many UK charities promote (and if you didn't know, the daddy of all virtual giving is heifer.org who has been fundraising with livestock gifts for decades – which begs the question, why did it take us so long to catch on to the idea here in the UK?)

In December 2007, Kiva sold $2.2m in gift certificates, with over $250,000 worth purchased on Christmas Eve alone. At $25 each, that would mean a massive 88,000 were bought throughout the month.

If we compare this against last Christmas, we see that December 2008 wasn't so great. The peak is both shorter and slimmer.

Which brings us to the second chart.

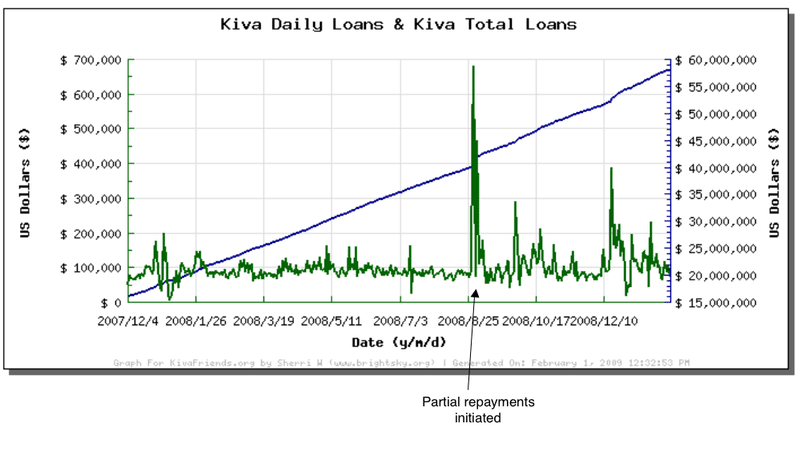

This shows the amount lent on a daily basis (green) against the overall total (blue). I've highlighted the massive spike in August which is down to a change in the way Kiva refunds loans which allows money to be re-lent at a faster rate). What's important is that loan value was up in December. In fact, Kiva had a record month. This is because most Kiva members never withdraw their money. Something that gives Kiva a great deal of economic resilience.

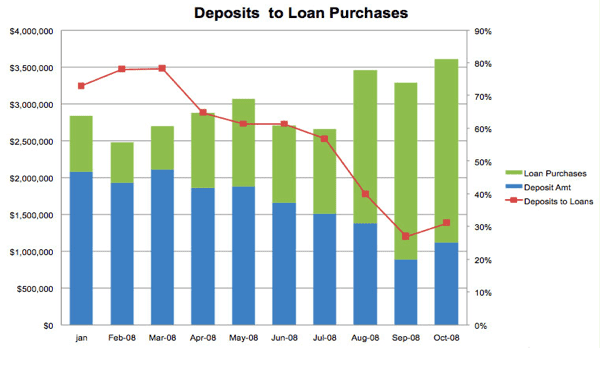

But overall, As Kiva CEO, Matt Flannery states on Kiva Chronicles, new money was down 25% since October. Re-lending has taken over as the majority of lending, which this chart taken from the Kiva Chronicles blog demonstrates very well (blue represents new cash, whilst green is total lending).

What this is down to, I'm not sure. It could be the impact of the recession; it might just be that the PR machine that picked Kiva up has moved on to something else; it might be that Kiva has reached a plateau with their current recruitment model.

Whatever the reason, Kiva's growth since they set up has been fantastic. Their web based offering has attracted a number of the main Silicon Valley players who have helped Kiva recruit thousands of new members – Paypal, YouTube, Google, Yahoo, Intel, Facebook, Linkedin, Microsoft, Myspace, Videojug and others all appear as Kiva supporters. YouTube alone has donated 120 million free banner placements, and at one point was driving 15% of all traffic towards Kiva.

In any case, I don't think Kiva needs to be unduly worried. Their growth is still being high-pressure pumped by an incredible amount of free publicity and corporate support. As a result they have a fantastic base of members – almost 420,000 at the last count (with 5,735 new lenders in the last week alone).

But currently – and this is the crux of the issue – it seems that too few of these members give again. Matt Flannery reported in March of last year that 40% of all money repaid was sitting in the Kiva bank account as unused Kiva credit. Kiva's response has been to introduce an unused credit policy where long-term dormant money is treated as a donation to Kiva.

To my mind, this response might need a little extra something added to it. At Bluefrog, we have a simple formula:

lack of engagement = fragile relationship = lapsed donors

And it would appear that a large number of people have been excited by Kiva, lent some money and then simply got on with their lives.

That's why I chose the title for this post. Fundraisers may not be web-entrepreneurs, but they know a thing or two about getting people to keep giving to great causes and it seems that a brilliant fundraiser may have some of the skills that Kiva needs in the next stage of its growth.

But until the call comes, I've added a couple more entrepreneurs to my personal portfolio. If you are interested, you can check it out here and then maybe start lending yourself.

Tags In

Related Posts

1 Comment

Comments are closed.

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

A guide to fundraising on the back of a postcard

What does the latest research tell us about the state of fundraising?

Great post.

I run an organization that maintains a pretty large portfolio on Kiva as part of our financial portfolio/charitable impact (www.globalafc.org, portfolio at http://www.kiva.org/lender/globalafc) and have been actively working with/tracking and a fan of Kiva since 2006 when we launched our org.

I also read the forge blog referenced above with great interest, and find myself coming down more strongly on the side represented in this blog. I think while forge copied much of the Kiva model, their message simply wasn’t as pure and clean – from everything I’ve read they are an amazing organization, but Kiva is so straightforward, and such a clean message, that this is what lends to its stickiness factor…

We’re hoping this is true, as we’ve launched something that hopes to capitalize on this idea, minus the lending factor, to provide crowdfunded scholarships in the developing world.

http://www.educationgeneration.org. If we’re right, and the Kiva model is more about 1-1 connections, community based crowdfunding power, we’re looking for significant growth – if its the loans that make it stick, than we’ll have guessed wrong but hopefully make a meaningful impact for a few deserving kids.

Great blog Andrew!

Shawn Smith