Is there something irregular about regular giving?

I’ve just published another video on LinkedIn that looks at regular giving (or recurring giving or committed giving, depending what terminology you use). Skip to the bottom of the page if you’d like to cut to the chase and watch it now.

You’ll see that the question that I ask – and try to answer – is whether the RG strategies used by some big charities are actually that effective?

You might have guessed that I’m a bit of a fundraising geek. But let me let you in to a secret – I actually collect charity annual reports. This collection goes back years and allows me to analyse what’s happened to fundraising at an organisation level for a series of charities over the last few decades.

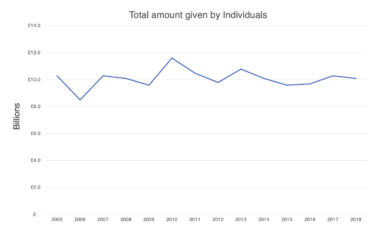

In the video, I share some numbers relating to RG income (and in two cases, expenditure as well) for four charities going back to the 2000s. For ease of comparison, I’ve chosen four charities all operating in the same broad area of work.

You’ll see that many charities are spending millions of pounds each year, just to witness their RG files shrinking in size and value. The video shows details of a charity which was generating £58 million in 2007 and now has an RG income of just £41.9 million.

That’s after spending an average of £7.2 million each year on costs which adds up to £122.2 million in total.

If they had just managed to keep pace with inflation, their RG file would be bringing in over £94 million today. That means they are looking at a shortfall of over £52 million in real terms from where they were in 2007.

Obviously if you look at their numbers in any specific year, the ROI looks fine. But over the long term, so much shrinkage against such a large budget should set alarm bells ringing. They spent £8.7 million in 2023 to see RG income fall by half a million pounds compared to 2022. Is that really a sensible use of funds?

In the video, you’ll see another two examples of charities with similar levels of decline in RG income.

But the fourth charity I feature is bucking this trend. Back in 2005 their RG income was £5.5 million. It’s now well over £23 million. Why such a difference to the other three charities?

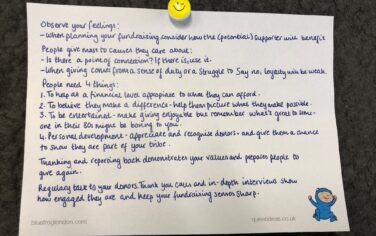

At Bluefrog, when we speak to regular givers, we hear three main issues:

Many regular givers report that they don’t get much sense that their support is achieving a great deal. They are normally giving a relatively small sum each month that can soon be forgotten amongst a sea of direct debits so their gift can be seen as a ‘payment’ rather than a charitable gift with tangible rewards. This creates very weak bonds of attachment.

Others tell us that they didn’t intend to support a charity for very long when they set up their direct debit. For some it could be a few months, though perhaps a year is the length of time we hear mentioned most often. In short, when they signed up, they were already considering the way out.

But perhaps, most importantly, many regular givers tend to eventually develop a self-imposed limit on how many regular gifts they will maintain at any one time. This is a reason why it’s so much harder to get an older donor to agree to a regular gift – they have reached their personal limit.

Each person’s limit varies, but we tend to find that once someone has 5, 6 or 7 regular gifts they start thinking, that’s enough. When they agree to set up a new RG, it tends to be on the basis of one in – one out.

In this situation, the charities most at risk are either…

• The larger ones where donors consider that a gift of £10 or so won’t be missed.

• The organisations who donors don’t feel particularly warm towards. These are usually the charities who fail to provide updates on how a donor’s gift has been used or who haven’t put any effort into showing the donor that their support is appreciated. Or, obviously, those who have suffered some form of scandal.

The fact is, when you look at the data, charities will have a core file of regular givers that stick around year after year. This is great at one level as it’s reliable income – but it can also serve to disguise what is actually happening in an RG file where, as my examples show, even a huge investment isn’t able to keep up with inflation – let alone offer the opportunity for growth.

That’s because far too many regular givers don’t stick around. As one donor said to us in a recent research study…

“They seemed to think that because I said yes, I was going to stick around forever. I only agreed when they stopped me because they didn’t want that much money. I don’t really know anything about them.”

Which brings us back to that fourth example – the charity that has sustainably grown their number of regular givers over the last two decades. That charity offers supporters the chance to fund work that they value. And they give them a strong sense that they are a valued part of the organisation.

As I point out in the video, this strategy isn’t magic. It’s simply focusing on and responding to the needs of donors. I hope the video is useful. Thanks for watching.

Tags In

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

A guide to fundraising on the back of a postcard

What does the latest research tell us about the state of fundraising?