Do you need some help?

Most fundraisers work with tight budgets and to tough targets. It's part of the territory of fundraising.

Creative thinking, a focus on the needs of the donor and great database management can only take you so far.

Sometimes you need help.

But who do you turn to?

There are many consultants, agencies and websites out there that can offer advice on improving strategies and fundraising materials. But maybe you should start off by looking a little closer to home.

How about within your own charity?

I can't think of many organisations where financial management is the sole responsibility of the Finance Department and people management is just down to Human Resources. So why is fundraising so often stuck in a silo of its own?

It wasn't always the case. The YMCA, for example, used to have a very simple employment policy – your first job was to raise your own salary.

I've always thought it a stroke of genius. It means every single member of staff becomes part of the fundraising team. With joint responsibility for finding the money to keep an organisation going, everyone thinks very carefully about the impact on fundraising of changes in policy and strategy.

Take the need for unrestricted income for instance.

Most charities look at their direct marketing programme as a significant source of unrestricted funds. The juicy earmarked projects are normally saved for trust and statutory funders.

It certainly makes accounting easy, but is the blanket approach that all appeal income should be unrestricted, the best way to fundraise?

I'd suggest not.

We were looking for ways to increase income for one Bluefrog client and part of our approach was to create an appeal that offered donors the chance to allocate their gifts to specific projects.

Donors really appreciated the chance to have a say in how their money was used. Income increased by a significant amount and feedback was very positive.

What was particularly interesting however was that 80% of donors still gave the charity the final choice on how to use their dontion. This resulted in the appeal bringing in much more unrestricted income than was originally budgeted along with another large chunk of earmarked income.

More money and happy donors. That's not a bad result.

None of this would have been possible if we hadn't shared the problem with the finance team. When we explained what we wanted to achieve, theyresponded by changing the way they worked.

Next time you are putting a budget together or developing a strategy, why not ask those who work with you how they might be able to make fundraising more effective.

Who knows what they might come up with?

Tags In

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

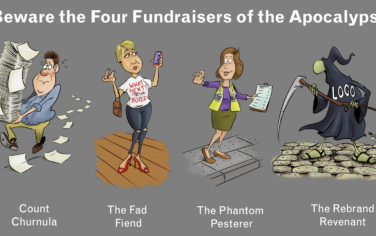

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

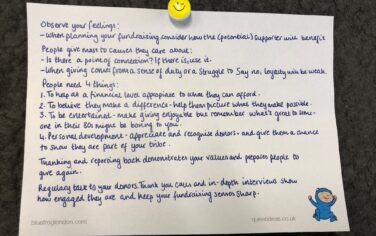

Why do people give? The Donor Participation Project with Louis Diez.

A guide to fundraising on the back of a postcard

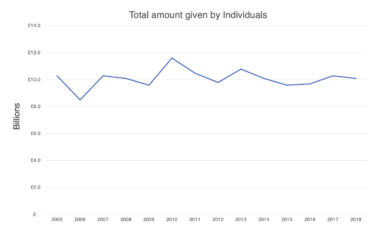

What does the latest research tell us about the state of fundraising?