Why we can afford to be confident

One of the key factors influencing Bluefrog's bullish approach to the impact of the recession on the voluntary sector has been the relatively high levels of economic confidence amongst our key audience.

Though the January ICM crisis index indicated that the majority of people (78%) believed that the economic situation will get worse over the next three months, this didn't transfer to their own personal circumstances – the same study found that 70% of people thought their family income would increase or stay the same in 2009.

The January 2009 Guardian/ICM poll found that personal confidence was on the rise. Asked about their personal circumstances, 51% said they are fairly or very confident – up from 43% in December (and only marginally down on the situation in February 2008 when it stood at 55%).

And it is this metric which I think gives us most reassurance.

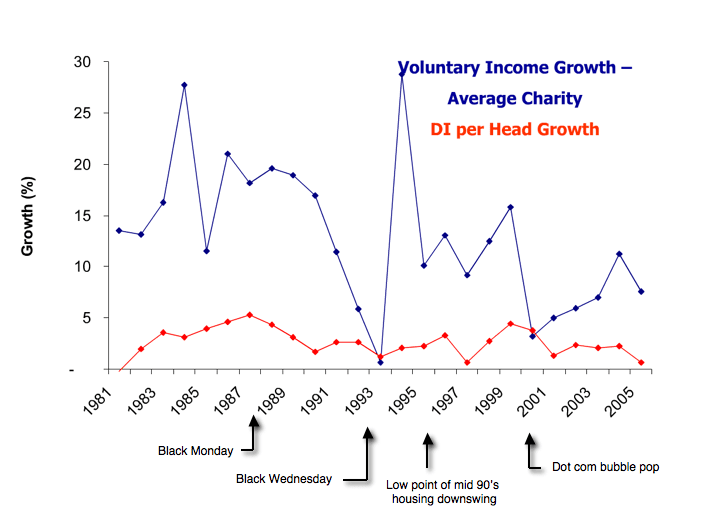

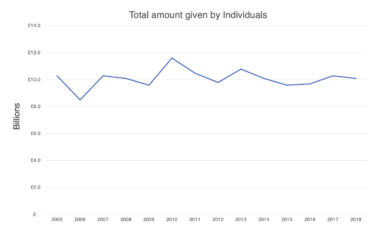

The work undertaken by nfpSynergy last Autumn is very interesting in this respect. They examined the financial history of 56 of the UK's top fundraising charities over 25 years to assess the relationship and timing of the impact of fluctuations in the UK's economic fortunes on the voluntary sector. The chart that interests me the most is the one where they compare disposable income and voluntary income growth. As you'll see, donations broadly rise and fall in line with available cash.

But I don't think this explains all the wiggles or the extreme fluctuations we can see.

We have to Ignore the massive peaks in 1984 (Ethiopia and the Bhopal disaster) and 1994 (Rwanda Genocide and economic bounce back). But even so, the movement in voluntary income growth doesn't seem to me to be just related to fluctuations in disposable income. There does seem to be a close correlation, but it seems another, if associated factor, is at play. That of economic confidence.

As you'll see, I've marked some of the most important confidence sapping economic events of the last twenty-five years on the graph and you can see that they raise their ugly heads at just the right time – when confidence is low, voluntary income growth stays low, even when there is an upturn in disposable income growth.

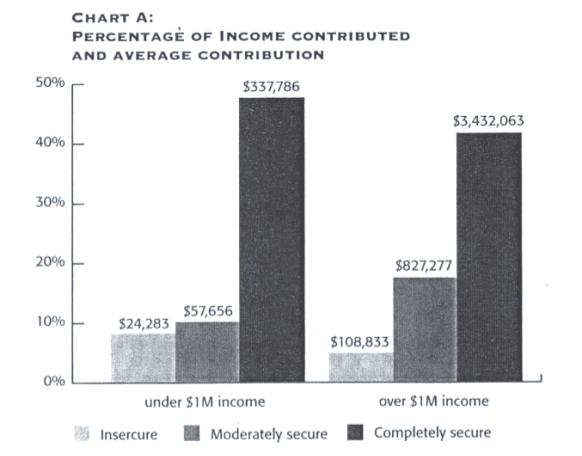

Schervish, Havens and Whitaker looked into the influence of confidence amongst elite givers in their paper, Philanthropy's Indispensible Ally, in 2005. They found that a sense of financial security strongly determined giving behaviour.

The American study surveyed 112 donors, all of whom had a net worth at or above $5 million (25% had a net worth at or above $50 million) and asked them to rate their own financial security from zero to ten (completely secure represents a ten, moderately secure is an eight or nine and insecure is seven or less).

As you'll see from the chart below, as income (or net worth) grows so does giving, but security – over and above wealth – accompanies large increases in donations. For instance, those people with significant net worth (over $15 million) who felt completely financially secure were likely to give five times as much of their income to charity as people with similarly substantial levels of wealth who felt insecure.

And one of the things we are finding in this recession is that anxiety is primarily being felt by the poorest people – those who are most immediately exposed to the recession and are least likely to benefit from low interest rates. 62% of people in the DE economic category are worried about their future – a group that doesn't have the economic strength to give significant amounts to charity.

Our key donors in the ABC economic category may have been shaken by the recession, but the evidence presented by the many strong Christmas appeals we have seen shows that as long as they remain confident of their own financial security – and we continue to take their needs into account in our fundraising materials – our security will also be assured.

Tags In

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

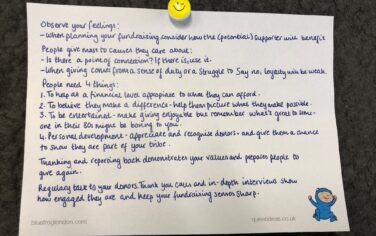

A guide to fundraising on the back of a postcard

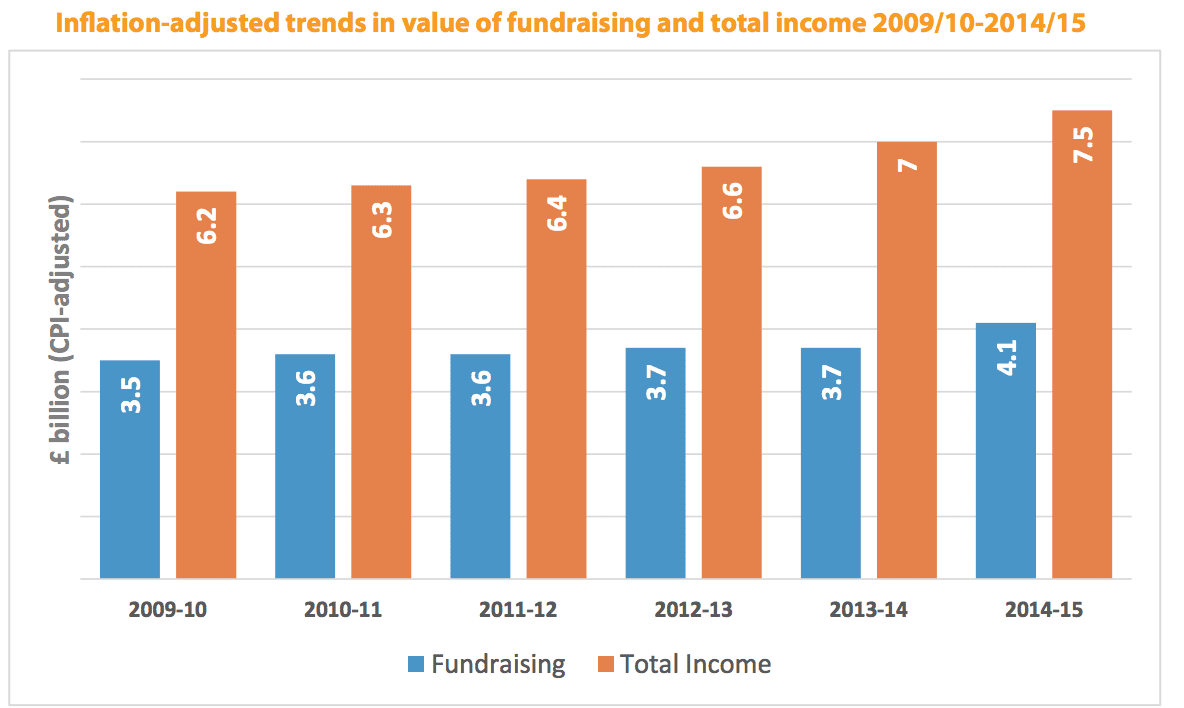

What does the latest research tell us about the state of fundraising?