Why I had to close Bluefrog down (and why I set up Bluefrog Fundraising)

UPDATE - 15 July 2015: HMRC reversed their decision on retrospective payments, in effect allowing agencies like Bluefrog to apply the new interpretation of rules moving forward rather than trying to reclaim the previous six years worth of payments (that were unrecoverable from charities). In other words, Bluefrog closed for nothing. Details are here.

UPDATE – 19 April 2018: A recent appeal to the VAT Tribunal by a company with much deeper pockets than Bluefrog has succeeded in overturning the decision to reinterpret the rules relating to the printing and delivery of mailing packs.

If the case is not appealed, or if the Upper Tribunal supports the first-tier tribunal’s view, then it is likely that HMRC will have to revert to its original guidance.

As Graham Elliott, a VAT consultant with City & Cambridge, and an adviser to the Charity Tax Group states in an article in Civil Society:

“All of this has visited a great deal of difficulty on charities and their printers, and wasted a lot of their time...If this decision is upheld then all of that will have been proven unnecessary.”

As you might imagine this has left me pleased but still feeling sickened over what happened to Bluefrog. My original post from 2017 on this matter follows.

A few rumours have been circulating regarding the closure of Bluefrog Limited, so I thought it might be useful to explain what happened and share the reasons why the company closed and why all work and staff were transferred to a new company, Bluefrog Fundraising.

Running an agency is hard. Margins are tight, you face ever-changing regulations relating to employment and fundraising and of course you need to look after your staff and clients. Once you have managed all that, you need to do the work you are actually paid for. And then you can send out the invoices with the correct amount of VAT.

And that’s what we tried to do. And we did very well. Until summer 2016, when a letter from HMRC arrived and explained that we might have things wrong and we should go back through all jobs since our last inspection and check if we had applied the correct rate of VAT to every invoice.

We complied, and we believed all invoices were accurate. After all, we were under the impression the regulations hadn’t changed. And over the previous 19 years we’d had five VAT inspections that we’d happily passed. In the notes that various VAT Inspectors had recorded after their visits, we had been described as “beyond reproach” and “very knowledgeable”.

So the men from the HMRC came to visit. And they explained that although the rules relating to VAT had not changed, their interpretation of them recently had. And they thought that there could be a frightening amount of historical VAT payments outstanding.

VAT related to charity advertising and fundraising is complicated. I’d actually been asked to give evidence to a committee in parliament a few years previously where I had identified the tax as a time bomb for the sector. At that point, I hadn’t realised we’d be so badly caught in the explosion.

The problem is that the rules have been a mixture of various regulations that no one appeared to fully understand. They operated a little like this…

The supply of fundraising materials could be zero-rated as long as it was classified as a single supply where the same supplier created the appeal, managed the print and it’s delivery to the donor.

And when it came to the components of an appeal pack, as long as the majority of elements were zero-rated, the whole pack could be zero-rated (this was known as the package test).

The men from HMRC explained this was no longer the case. After a long period of consultation with the DMA and the Charity Tax Group, they had reached agreement to reinterpret the rules regarding VAT as applied to fundraising and direct marketing materials.

That meant that things had changed – dramatically.

The whole idea of a package test was completely changed. Under the new interpretation, as an agency, if you provide a service to a charity that is subject to VAT, it is subject to VAT – no arguments. This means things like creating an ad or a mailing pack need VAT charged on them at the standard rate.

Artwork and pre-production can, under certain circumstances, be zero-rated but the whole idea of single sourcing is not an option. Once it was important for one supplier to undertake all tasks. Not any longer. Now the charity must contract directly with the media company / supplier / printer who can supply the advertising space to the charity customer and zero rate this supply provided the relevant conditions are met.

As an example, if an agency is doing anything more than buying space, it appears that a whole insert or door drop campaign becomes standard rated. That includes offering advice on which publications or postcodes should be used and when.

Some elements of data work can be zero-rated but only relating to MPS, removing gone aways or deceased donors and ensuring output format complies with Post Office regulations. Everything else is standard rated.

But that isn't the end of it. These rules aren’t just for the future. They are backdated. And what’s more, if you issue a correction VAT invoice to a client, you have to add another 20% to it in additional VAT charges.

The good news for charities is that the onus to pay any wrongly assessed VAT falls to the supplier.

A letter from Andrew Edwards, Deputy Director, Specialist Personal Tax, Charities of HMRC to Peter Lewis, Chair of the Institute of Fundraising and Caron Bradshaw of the Charity Finance Group dated 15 September, 2014, states, with regard to the change in interpretation of the rules regarding VAT charges:

“Any retrospective charges where VAT has not been applied correctly would fall to the marketing company, not the customer.”

However there is a caveat regarding responsibility that does apply to charities. You can't use techniques to artificially reduce your charity’s VAT liability.

For example, if you employ an agency to develop your charity’s creative work and you chose to pay them via a printer to avoid VAT, you may have broken the rules.

That wasn’t the case at Bluefrog as we always billed our clients directly.

So after this shocking revelation, we obviously took advice from legal and financial specialists and spoke to other suppliers and clients. But at the end of the process, we found ourselves in a position where we could either agree with the opinion of HMRC or face a long and expensive battle that, sadly, Bluefrog’s pockets weren’t deep enough to accommodate, particularly after we were advised that any appeal would only have a limited chance of success.

After accepting the point of view of HMRC, I was left with no choice but to close Bluefrog Limited down. We simply could not afford to pay the sums owing. I don’t think I’ve ever faced a more difficult and soul-destroying decision in my life. My attitude to tax has always been to pay what was due. I’d never used common techniques of tax avoidance such as paying my partner for a non-existent job.

And for the avoidance of any doubt, I should point out that zero-rating meant that Bluefrog didn't charge charities VAT on fundraising materials. So they didn't pay it. Bluefrog Limited didn't make a penny on this process. The company never received the VAT payments that HMRC wanted to reclaim.

With the agreement of the administrator, all Bluefrog employees were transferred and work in progress was sold to a new independent company under my control, Bluefrog Fundraising. All suppliers have been or are being paid in full for their work. And no charity will lose out, as their work has continued without interruption or additional cost.

But that’s not the end of the problem.

Bluefrog Limited wasn’t alone in accounting for VAT in this way. It was (and still is) common practice across the sector. Sadly, it appears that a large number of suppliers of fundraising and direct marketing services to the charity sector are, or will be, in the same difficult situation that Bluefrog Limited found itself in.

If anyone would like to speak to me in more detail (from supplier or charity side) about what happened, I’d be happy to share the advice we received and our thinking. HMRC are serious about this and if you aren’t applying the rules correctly, it won’t be long before letters marked HMRC start appearing in your postbag. Whatever you do, don’t hide your head in the sand. Make sure you receive the best advice possible and be straight with HMRC. They aren’t unsympathetic, but they will not be turning a blind eye to organisations that apply the old interpretation of the VAT regulations, no matter what anyone says.

The new company, Bluefrog Fundraising, employs the same staff and will continue to offer the great advice and creative that Bluefrog Limited was always known for. It is fully funded and is abiding firmly by the new interpretation of VAT rules.

Whatever you do, I wish you the best of luck. It's not been the most pleasant of times and now I just want to get back to doing what I love the most – fundraising.

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

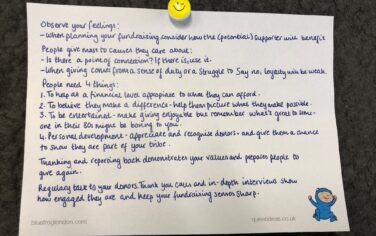

A guide to fundraising on the back of a postcard

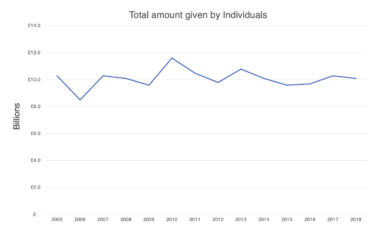

What does the latest research tell us about the state of fundraising?