City bonuses – another reason to be cheerful

One of the range of strange but incredibly useful activities we undertake at Bluefrog is keeping a close eye on the various global stock-markets.

Much of the success of our high-value donor recruitment programmes can be directly related to our approach of targeting men and women with fairly large lumps of available cash.

The city is a pretty good source of these people, and as much we might like to think of them all as a bunch of uncaring fat cats, there are a good number that give substantial amounts to charity.

Unfortunately, if they are not getting bonuses, they become less generous. It's something that has become more and more obvious over the last couple of years. Though response rates have been fine, average gift has taken a bit of a beating.

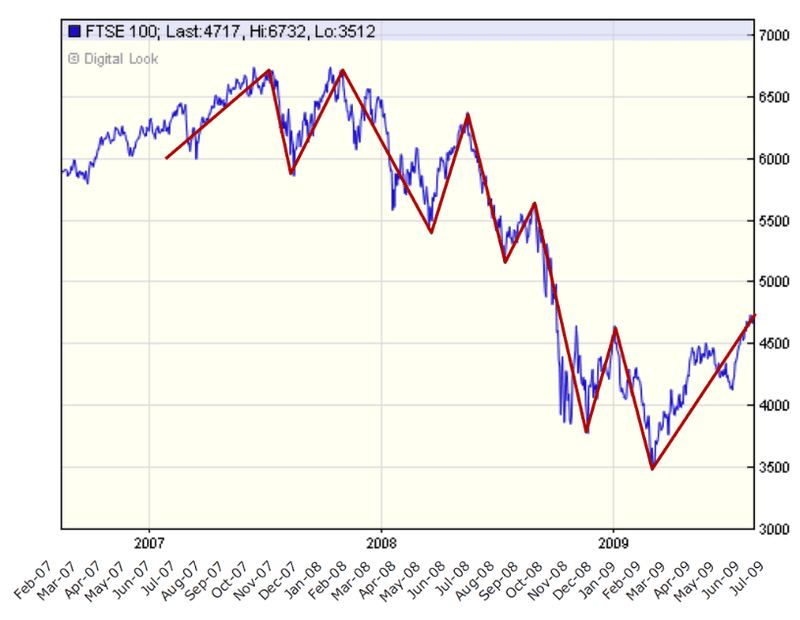

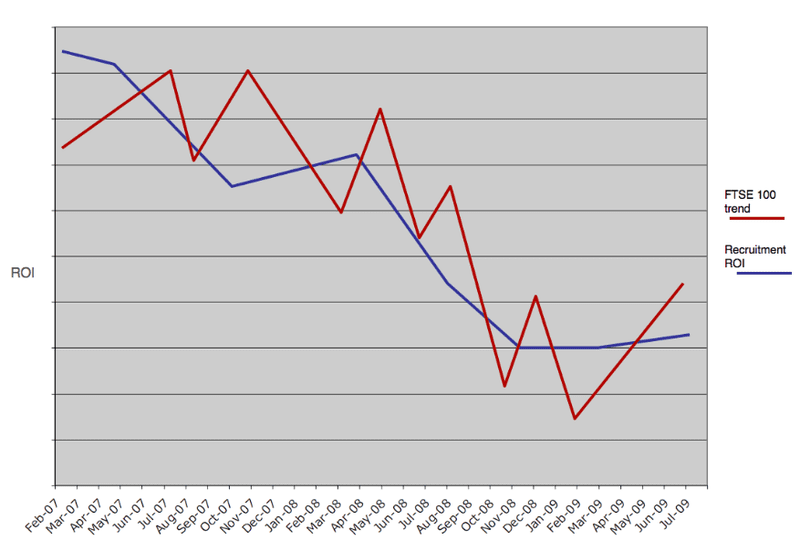

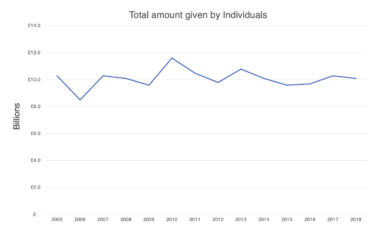

As part of our planning for the next six month financial cycle, we have been comparing recruitment ROI with movements in the FTSE 100. Chart 1 shows the FTSE over the last three years overlaid with a trend line.

Chart 2 shows a representative example of high value recruitment ROI achieved since the start to 2007 compared to the FTSE 100.The similarity is startling. As the FTSE started its tail spin so did the size of average gifts.

What is exciting me at present is we are now starting to see the stock market rise and with it will be the return of bonuses, dividends and profits. The influx of this income into city wallets and purses will be followed by donations to charity.

As Chart 2 shows, we have seen a plateau and now some real growth in ROI on some of our recruitment activity and with pay packets beginning to expand, I'm very confident that average gift will continue to rise.

The proof will be in our appeals, but I'm approaching this Christmas in a very bullish state of mind.

Tags In

The Essentials

Crack the Code to Regular Giving: Insights, Strategies, and a Special Giveaway!

‘Tis Halloween. Keep to the light and beware the Four Fundraisers of the Apocalypse!

Why do people give? The Donor Participation Project with Louis Diez.

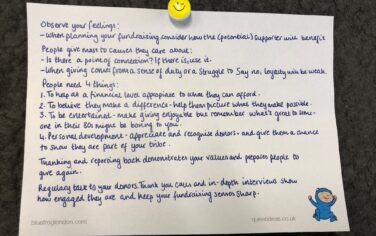

A guide to fundraising on the back of a postcard

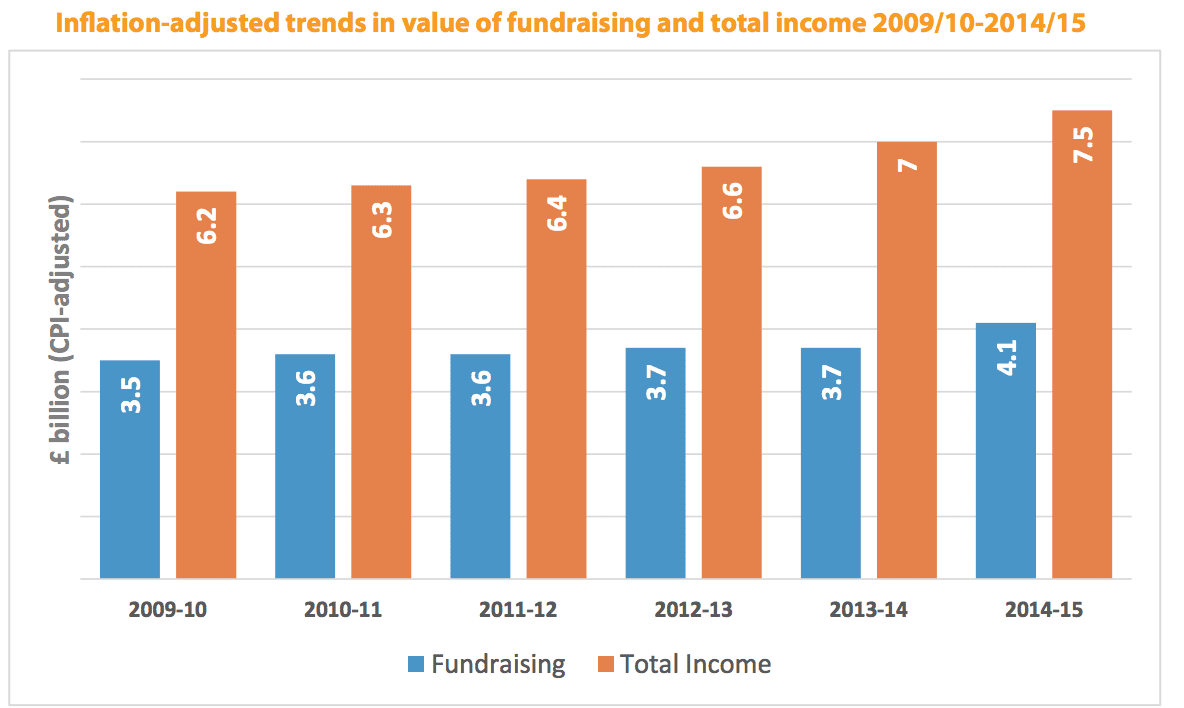

What does the latest research tell us about the state of fundraising?